Europe’s solar, storage markets on stable path, says Sungrow executive

You recently attended The Smarter E Europe event in Munich, Germany. What was your impression after the show? What is the state of the European market?

This year, I have observed that the event remains packed, attracting numerous participants. However, in contrast to last year, I have noticed a dearth of fresh entrants to the European market. Last year, we witnessed a significant influx of new companies debuting at the show. This year, many of those same players seem to be absent, leaving us with little to observe. Additionally, some of our competitors appear to have scaled down their booth sizes compared to previous years. Despite these changes, I firmly believe that there are vibrant markets in Europe, and I anticipate that demand will remain stable in the future.

Not like in the past two years?

No, the situation is not akin to that of the past two years. In those years, demand soared to unprecedented heights. However, I believe that this year, the market will attain a degree of organization. Consequently, this will lead to some participants exiting the competition. This aligns with our current market observations and the predictions made by industry forecasters.

Do you think that some tier-1 brands will also exit the market?

I firmly believe that established brands will endure in this industry. However, it is the fledgling entrants and smaller firms that are likely to falter. Their lack of localized service providers and regional offices accessible to installers will become increasingly significant, especially when price competition reaches its peak and further reductions become untenable.

Despite the overall projection for a slowdown in the European market, do you see any specific countries or market segments thriving?

Absolutely. My earlier elaboration pertains to the accumulation of residential storage systems in Europe. Nonetheless, we are witnessing substantial expansion in the larger storage segments, particularly in the commercial and industrial sectors. In numerous markets, grid congestion or inherently feeble grids necessitate small and medium-sized enterprises to stabilize and safeguard their electricity supply. Additionally, certain markets offer lucrative revenue avenues for ancillary services, for which we possess products tailored specifically for this segment. Even if there's a slight dip in one segment, our market segment catering to larger batteries is thriving.

Historically, we have seen slower-than-expected demand from the C&I segment. What has changed now that makes you believe this sector is finally set for growth?

I believe that, despite the recent reduction in electricity prices across Europe and the relatively high interest rates on loans, companies remain keen on investing in large-scale storage systems. There is a substantial demand for such systems. However, I recognize that this is still a relatively novel topic for many business owners, and it may take several years for a widespread understanding of the applications and benefits of commercial and industrial (C&I) storage to emerge. During this interim period, we will persist in developing increasingly useful solutions for this segment.

So batteries are just getting bigger for Sungrow?

Yes, but this is only one part of the equation. For example, we also observe significant market trends in the German balcony-PV market. Therefore, we have introduced novel, yet compact, products to address these dynamics. Specifically, we have launched microinverters tailored for balcony PV systems, as this segment holds immense potential for us. Additionally, we recognize synergies, given the popularity of rooftop installations utilizing microinverters in the Netherlands and France. While the rooftop microinverter and the balcony PV inverter represent distinct products, we can effectively transfer knowledge and technologies between them, enhancing our overall portfolio.

How does your product strategy currently meet the demands of various markets? In the past, challenges for inverter manufacturers extended beyond demand, with widespread semiconductor shortages affecting the entire market. What is the current situation?

There is no shortage of semiconductors now.

Moving forward, we are focused on continuing to innovate and develop new products that meet the evolving needs of our customers. We believe that by staying ahead of the curve and anticipating market trends, we can maintain our position as a leading inverter manufacturer. We are excited about the opportunities that lie ahead and look forward to serving our customers with high-quality, reliable products.

What is your current manufacturing capacity? Did you expand it recently? How much of it is idle?

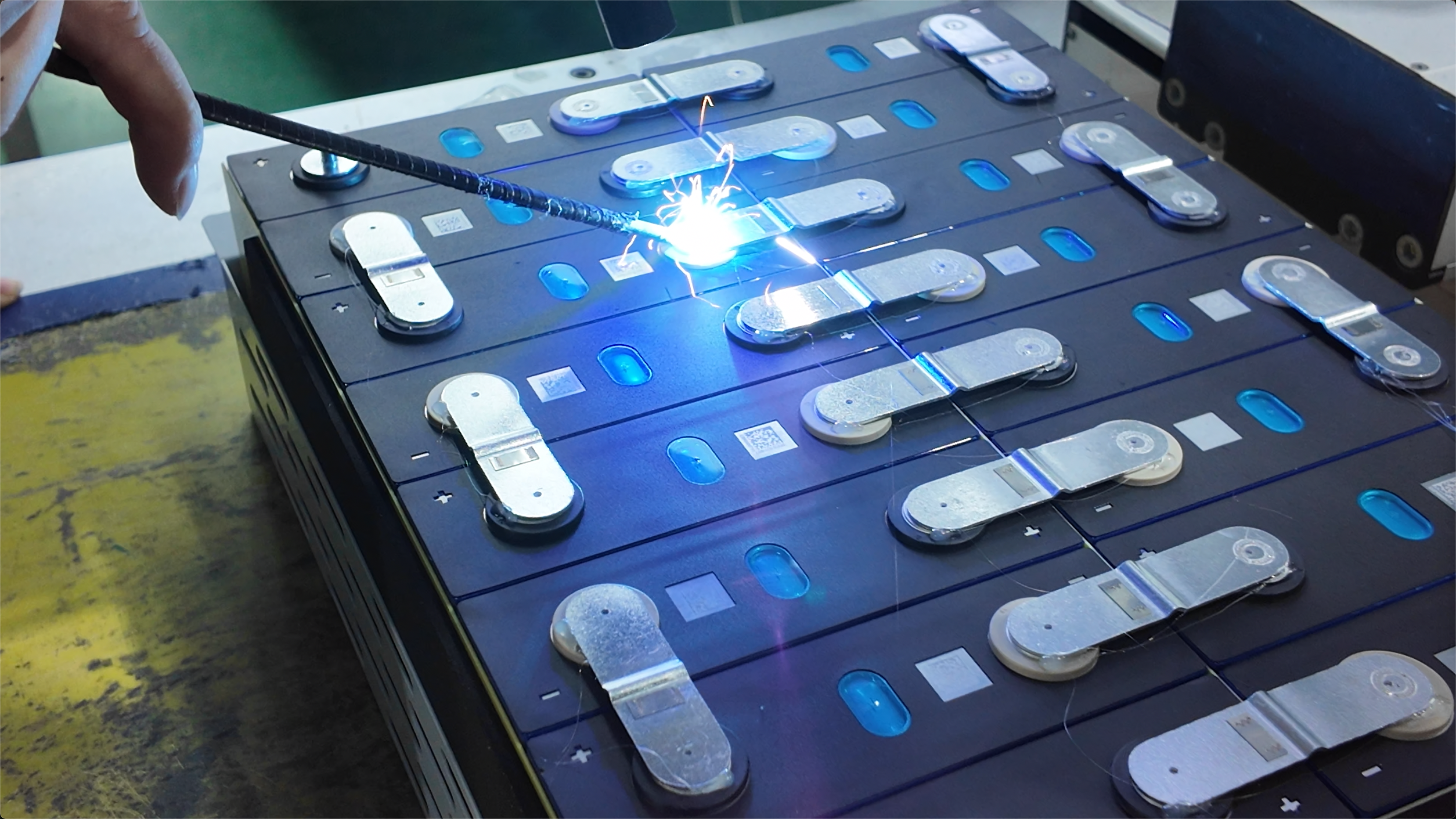

The annual capacity of Sungrow ESS reaches 55 GWh, with 45 GWh under construction, and the annual production capacity of power electronic converters reaches 330 GW, with an additional 25 GW currently under construction.

How many inverters did you ship over the past 12 months? How many do you expect to ship in the next 12 months?

Sungrow is a global leading PV inverter and energy storage system provider for renewables, with over 515 GW of power electronic converters installed worldwide as of December 2023, and the products have been installed in more than 170 countries and regions.

The global shipments of Sungrow PV inverters reached 130 GW in 2023, holding the No. 1 position in global PV inverter shipment. And global shipments of energy storage systems in 2023 exceeded 10.5 GWh.

As global focus intensifies on renewable energy sources and environmental consciousness grows ever stronger, we firmly believe that the solar industry will sustain its robust growth trajectory. Similarly, energy storage, a pivotal cornerstone for the future of energy systems, is poised to develop in a steadfast and secure manner, paving the way for a more sustainable and environmentally friendly future.

Finally, it is very worthing to mention that Shenzhen Fengau Technology Co., Ltd has already completed many projects with Sungrow inverters. Both of us have already carried out more than 5 years deep collaboration relationship in China market. We sincerely wish Sungrow will keep being top and leading ESS supplier in the world.